401k contribution match calculator

Match your employee contributions. Your employers 50 match is limited to the first 6 of your salary then limits your employers contribution to 3000 on a 100000 salary.

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community

The employer can match 100 of the first 4 of employee contributions.

. For the tax year 2022 which youll file a return for in 2023 that limit stands at 20500 which is up 1000 from the 2021 level. In this example you would enter 3 percent in the Match Up to field and 5 percent in the Additional. 401k a tax-qualified defined-contribution pension account as defined in subsection 401k of the Internal Revenue Taxation Code.

Assuming no filing extension ABC must deposit their 2020 employer contribution no later than March 15 2021 to deduct the contribution on their 2020 tax return. There can be no match without an employee contribution and not all 401ks offer employer matching. If you increase your contribution to 10 you will contribute 10000.

3 Even if your employer match is less than that that extra money can make a big difference in your nest egg over time. Youve got a great employer who matches your 401k contribution 200. The total 401k contribution from you and your employer would therefore be.

What you provide as the employee and the match from your employer if applicable. Those who are 50 years or older can invest 6500 more or 27000. A 401k Contribution calculator will help one to calculate the contribution that will be made by the individual and the employer contribution as well depending upon the limits.

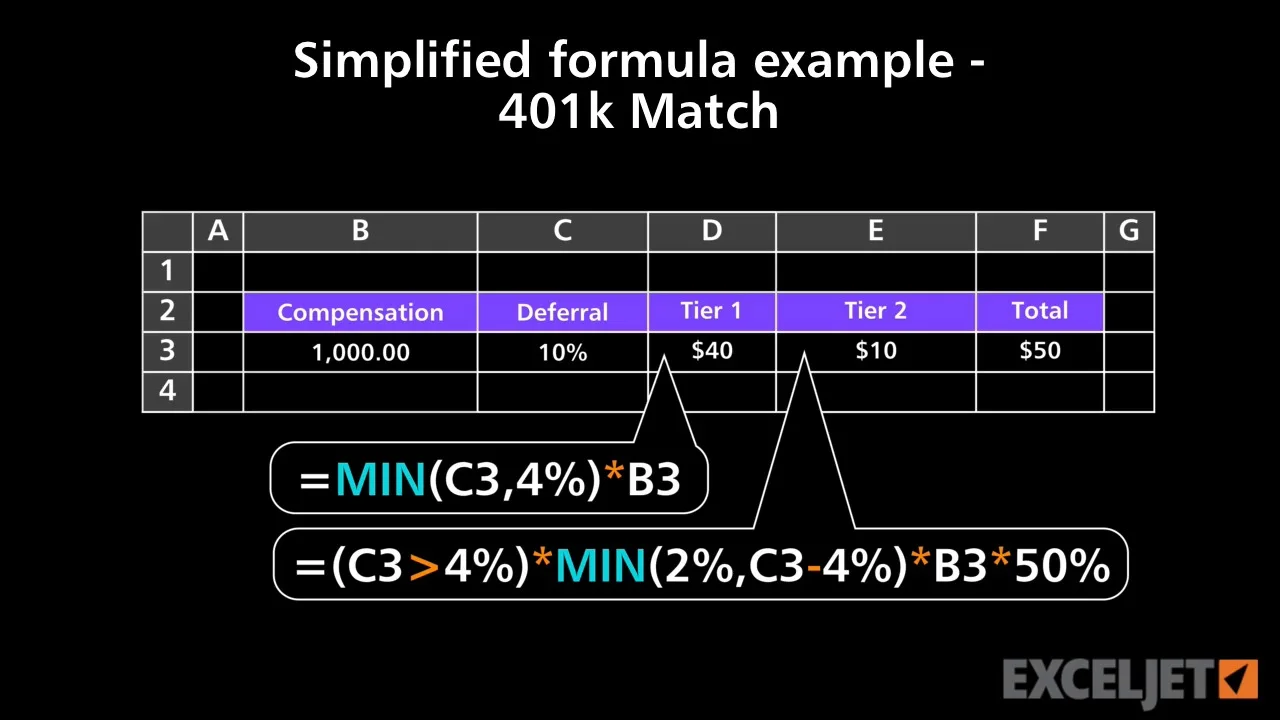

A 401k match is money your employer contributes to your 401k account. 100 and 6 respectivelyEmployer Match Annually box selected 10Years to Fund 401k 11Average Annual Interest Rate Earned Annually box selected Press View Schedule. Use the Additional Match fields if your employer offers a bi-level match such as 100 percent up to the first 3 percent of pay contributed and 50 percent of the next 2 percent of pay contributed.

401k Calculator A 401k is an employer-sponsored retirement plan. The employer can match 100 of the employees first 3 contribution plus 50 of the subsequent 2. Buy Car Calculator.

Matching 401k contributions are the additional contributions made by employers on top of the contributions made by employees. 401k Employer Match Calculator Many employees are not taking full advantage of their employers matching contributions. If you contributed 5 percent of your salary to a 401k plan your contribution would be 96 a pay period but your pay would fall by 82 assuming you were in the 15 percent tax bracket according to a calculator from Fidelity Investments.

You can only contribute a certain amount to your 401k each year. Their 401k plan operates on a calendar plan year. There are two sides to your contribution.

How to use the Contribution Calculator. 4 And the average employer 401k match is around 45 of your salary. That figure plus the value in step 1 will.

If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit or 27000 year 2022 limit for those 50 years or older in the first few months of the year then you have probably. You will have about 171725 in your 401k in 10 years assuming all variables are met of course. A 401k account is an easy and effective way to save and earn tax deferred dollars for retirement.

What are the 401k contribution limits in 2022. If you increase your contribution to 10 you will contribute 10000. Simple 401k Calculator Terms Definitions.

2 And the average employer match is around 45 of your salary. In addition many employers will match a portion of your contributions so participation in your employers 401k is like giving yourself a raise and a tax break at the same time. For tax year 2022 you can contribute 6000 to a Roth IRA or 7000 for those age 50 or older as long as.

There is an upper limit to the combined amount you and your employer can contribute to defined 401ks. Investors need to be aware what the annual maximum contribution is and not go over it. The good news is the vast majority of companies 86 with a 401k plan provide a match on employee contributions.

Example - ABC S-Corp is calendar year tax filer. Determine whether an employer is contributing to match the individuals contribution. The contributions made to a 401k plan should not exceed the IRS limits.

For 2021 the limit is 19500 and if you are over 50 the limit increases to. In 2022 you can contribute 20500 to a 401k. Inflation the rate at which the general level of prices for goods and services is rising and subsequently purchasing power is falling.

The employee contribution and the employers match. In fact about 86 of companies with a 401k plan provide a match on employee contributions. While an employers 401k match and non-matching contributions dont count toward your 19500 employee deductible contribution limit 26000 if you are 50 or older they are capped by.

Your employers 50 match is limited to the first 6 of your salary then limits your employers contribution to 3000 on a 100000 salary. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. Usually up to a certain limit denoted as a percentage of the employees salary.

For example suppose you had gross pay of 50000 a year and got paid every two weeks. 5 For an employee who makes 50000 a year thats an additional 2250 dedicated to their retirement savings each year. Contribution Calculator for 401k.

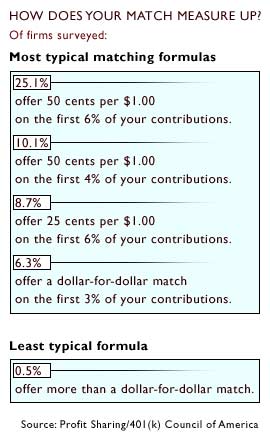

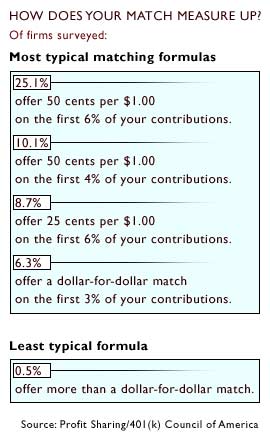

These matches are made on a percentage basis such as 25 50 or even 100 of the employees contribution amount up to a limit of total employee compensation. For each dollar you save in your 401k your employer wholly or partially matches your contribution up to a certain. Total contribution from yourself as an employee and an employer cannot exceed 61000 in 2022 or 67500 if you are 50 or older.

Over 90 of employers that offer a 401k plan also kick in a company match. Under a safe harbor plan employers can select between two contribution options. Anything your company contributes is on top of that limit.

The total 401k contribution from you and your employer would therefore be. The employer can contribute 3 of compensation to all employees that are eligible. 401k contributions comprise two sides ie.

If an extension is filed the deposit can be made up to September 15th.

Free 401k Calculator For Excel Calculate Your 401k Savings

This 401k Match Calculator Shows How Powerful Compound Interest Can Be

401k Employee Contribution Calculator Soothsawyer

401k Contribution Calculator Step By Step Guide With Examples

Excel 401 K Value Estimation Youtube

Retirement Services 401 K Calculator

401k Contribution Calculator Step By Step Guide With Examples

Excel Tutorial Simplified Formula Example 401k Match

Download 401k Calculator Excel Template Exceldatapro

Customizable 401k Calculator And Retirement Analysis Template

401k Employee Contribution Calculator Soothsawyer

What Is A 401 K Match Onplane Financial Advisors

Doing The Math On Your 401 K Match Sep 29 2000

Download 401k Calculator Excel Template Exceldatapro

Doing The Math On Your 401 K Match Sep 29 2000

401 K Plan What Is A 401 K And How Does It Work

401 K Calculator See What You Ll Have Saved Dqydj