43+ documents needed for mortgage underwriting

Mortgage underwriting is the review process in which a lender evaluates the risk of a borrower and a property. While there are some standard documents that are needed for the mortgage underwriting process you should also know that the underwriter can ask for additional documents.

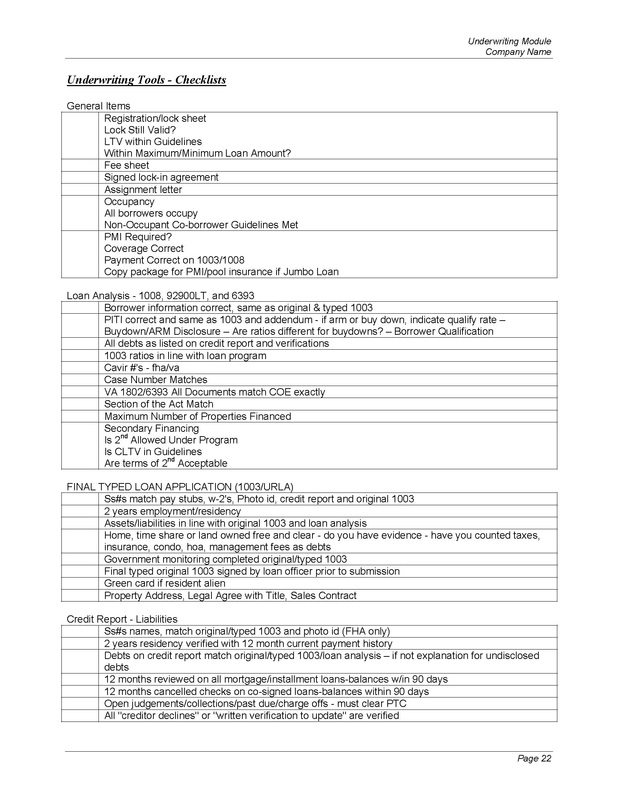

Mortgage Underwriting Procedure And Lending Credit Policy Mortgage Policies And Procedures Manuals

Credit capacity and collateral.

. This is not a complete list. Web Proof of homeowners insurance For a purchase you wont need this until just before closing Proof of income see below for specifics Source of down payment andor closing costs see below for specifics Wage earners who receive W-2 forms may need little else to get approved for a mortgage. Web The underwriter needs to know that you have enough income to cover your monthly mortgage payments.

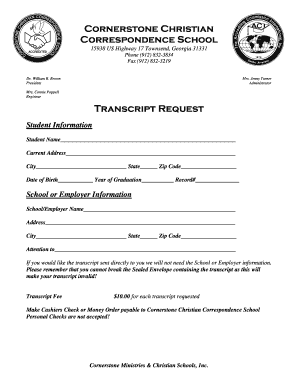

If applicable a copy of your divorce decree. Sometimes your lender will ask for these documents when you submit your application. Web Photo ID and proof of Social Security number.

The required paperwork can vary depending on your financial situation the type of loan youre applying for and the lender. More complicated or unusual financial scenarios may require additional documentation. Web An underwriter will take an in-depth look at your credit and financial background in order to determine your eligibility.

Documents required by mortgage underwriting. Web Documents needed for mortgage underwriting Evidence of earnest money Borrower letter of explanation LOX Gift letter Copy of note Source large deposits Verification of employment Fully executed sales contract Evidence of Earnest Money Copies of your cancelled earnest money check s or proof of wire. Lenders usually verify your employment by asking for your most recent W-2 and paystub.

Underwriting focuses on a borrowers 3 Cs. Through this process the lender determines whether to qualify. They verify the income you report and your employment status with your employer.

The first step is to fill out a loan application. During this analysis the bank credit union or mortgage lender assesses whether you qualify for the loan before making a decision on your application. Youll likely need to provide.

Other documents may be requested by your loan officer. Other information such as divorce. Web Common conditions to satisfy mortgage approval.

An underwriter then verifies your identification checks your credit. Web You will need to provide bank statements from the same account for the last 12 consecutive months as proof of income. Two years of tax returns.

Web Documents Needed for Mortgage Underwriting. They may also ask that your employer fill out a form with information such as your hire date your position your salary and your recent. If you are not a citizen a copy of the front and back of your green card.

Youll generally need to provide proof of your identity income assets and debt payments. Web Mortgage lenders request documentation to qualify you for a mortgage based on rules set by the CFPB and other government entities. Web All mortgage applicants will need these documents.

Valid Drivers License issued by a state that is not expired Military Identification Valid US. To help ensure that the process goes smoothly youll want to gather all the documents needed for mortgage underwriting. Other times they may call you to get more documents during the underwriting process.

Web A mortgage application typically requires a paper trail to verify. Income and asset verification Written verification of employment. Web The credit score required for a loan depends on factors like the lender and the type of mortgage.

Web Your underwriter needs to know that you have enough income to cover your mortgage payments every month. Lenders can only accept certain documents to validate the ID Verification Requirements. Web ID Verification Documents Required For Mortgage All lenders will need the identification of borrowers.

Residence addresses for the past two years. Web Underwriting occurs once youve completed your mortgage application and all required documents are turned in for the underwriter to review. Assist with the appraisal.

The borrower compiles required documents. ID and Social Security number Pay stubs from the last 30 days. Web The mortgage underwriting process is all the steps an underwriter goes through to evaluate your borrowing capacity and collateral after you apply for a home loan.

Government-issued ID Proof of income Proof you have funds for the down payment Permission to access your credit report the bank will have you sign a document granting permission Depending on your financial situation you may also need to provide. Web During the underwriting process youll provide financial documents including pay stubs bank statements W-9s tax returns and profitloss statements for self-employed applicants -- which. Web how we make money.

Youll need to set up an escrow account to cover taxes and insurance premiums. To prove this you need to provide three types of documents to verify your income. Requested documents may include.

Borrower Letter of Explanation LOX. Web Most lenders also ask for documents to verify this information such as W-2s paystubs and bank statements. Complete your mortgage application.

Credit Your credit score is a three-digit number that indicates how you manage and pay back debt. Bank statements W-2s and other tax documents Recent pay stubs Copies of forms of identification like your drivers license military ID or Social Security card. Here are the acceptable forms of ID Verification.

Web Before underwriting a loan officer or mortgage broker collects the many documents necessary for your application. W-2s from the last 2 years your two most recent bank statements and your two most recent pay stubs. The information you provide will help determine if youre eligible for a loan.

Since every situation is unique the exact documents youll need may vary.

What Documents Are Required By Mortgage Lenders Youtube

Complete Checklist Of Documents Needed For A Mortgage Mortgages And Advice U S News

The Mortgage Underwriting Process A Complete Guide

Mortgage Underwriting Procedure And Lending Credit Policy Mortgage Policies And Procedures Manuals

Complete Checklist Of Documents Needed For A Mortgage Mortgages And Advice U S News

Dear Underwriter What Documents Do I Need Simplist

How Loan Companies Do Underwriting Guarantor Loan Comparison

Mortgage Underwriting Checklist Template Fill Out Sign Online Dochub

Mortgage Underwriting Checklist Template Fill Out Sign Online Dochub

Mortgage Underwriting Checklist Template Fill Out Sign Online Dochub

What Documents Are Needed For A Mortgage Application

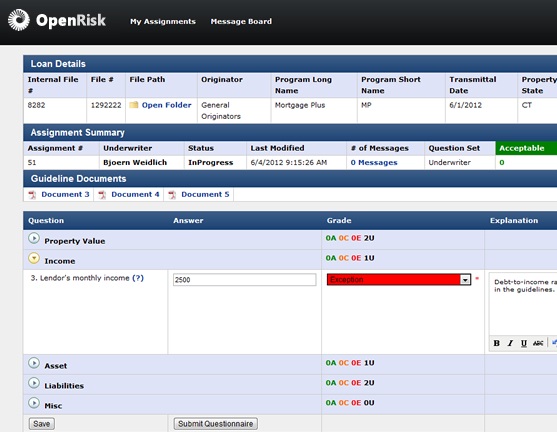

Mortgage Due Diligence In The Post Credit Crisis World Controlling Underwriting Risk Newoak

Oregon Financial Services Businesses For Sale Bizbuysell

Checklist Of Documents You Ll Need For A Mortgage Experian

Understanding The Mortgage Underwriting Process Bankrate

Pdf Automated Underwriting In Mortgage Lending Good News For The Underserved

Mortgage Underwriting What Actually Happens Mojo Mortgages